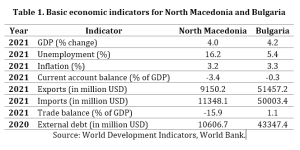

Author: Prof. Dr. Borce Trenovski, Faculty of Economics, University “Ss. Cyril and Methodius”- Skopje

A brief overview of Macedonian-Bulgarian relations and the potential for their development

After many years of attempts to establish mutual cooperation, the first serious rapprochement of the two countries N. Macedonia and Bulgaria established bilateral cooperation and dialogue in February 1999. The declaration of 1999 opened the doors for future potential cooperation between Skopje and Sofia in several fields of common interest. It covered a broad framework for future cooperation in several areas, which were directly or indirectly crucial for developing solid and close economic cooperation. This initial approximation of mutual attitudes and partial improvement of good neighborly relations was in several relevant fields of mutual interest – the development of infrastructure (energy, transport, telecommunications); facilitating the process of providing the necessary legal, economic, financial or commercial conditions for the free movement of goods, services and capital, and reducing customs and border formalities; expansion and development of transport connections along the lines of regional infrastructure projects; encouraging cooperation in the field of culture, education, health and other sectors, etc. Although both countries initially had a strong motive that bilateral relations should be improved in the future, and this will significantly affect the development of each individual state, however, in the following period, Macedonian-Bulgarian relations faced specific problems and challenges of a non-economic nature ( related to the past and different interpretations of history and cultural heritage) that did not allow using the full potential for mutual economic cooperation and development.

The Friendship and Good Neighbor Agreement of August 2017 was a new chapter in the development of mutual relations, which also represented a new basis for the development of economic relations between the two countrieN. The two countries ratified the Agreement in January 2018, putting the former relations between Skopje and Sofia on a new footing and bringing the two countries closer together through a partnership oriented towards the European Union (EU). The agreement provided for Bulgaria’s support for Macedonia’s candidacy for membership in NATO and the EU, improvement of trade and transport infrastructure and facilitation of customs and border formalities. At that moment, Bulgaria was the sixth largest trade partner of N. Macedonia, Bulgarian foreign direct investments (FDI) began to increase again in 2016, discussions began to be held on the joint improvement of road, rail, gas, electricity, internet connections – and it became clear that if socio-political relations were stabilized , economic cooperation and business growth between the two countries, has the potential to significantly advance and be a solid basis for the economic development of both countries. However, the implementation of the same Agreement from 2017 in practice was weak, often contested and interpreted differently by both sides. In October 2019, Bulgaria warned that it would block the road to N. Macedonia towards the EU if certain historical and

educational issues are not resolved, while in 2020 he vetoed the membership of N. Macedonia in the EU. In order to solve the problem, the “French proposal” appeared, which was fiercely debated by both sides. However, in the end, the parliament of N. Macedonia approved the French proposal and as a result N. Macedonia conditionally (taking into account that there is a protocol on bilateral issues, which serves as a detailed roadmap for future talks) started accession negotiations with the EU. But of course the process is not over and there is still a lot to do and many new challenges that can have a serious impact on the socio-economic well-being of both countries.

In this document, we will focus more on the development of economic cooperation between the two countries, which is determined – both by the deep economic changes experienced by both countries in the long-term transition process, and by their capacities/abilities to encourage their own economic development. Of course, one of the main goals is to determine whether the inter-neighborly and political relations had an impact on the intensity of economic cooperation and in which domains. This is particularly important for further creating solid foundations for the advancement of economic aspects of cooperation – and also sending a message to political elites – that economic cooperation and welfare can be an example of bridging differences, and a guide for overcoming political/historical/cultural/ social and other challenges that stand in the way of a better future.

Taking into account the previous one, in the next section we focus mainly on the analysis of the bilateral economic cooperation between N. Macedonia and Bulgaria in a long period of time. First, a comparative analysis of the two economies is presented in terms of several economic indicators in order to get an initial picture of the economic conditions in both countries. Then, we move on to the analysis of trade cooperation between the two countries, export/import, analysis of trade according to the Standard International Trade Classification, that is, how many specific groups of products participate in trade between the two countries. In addition, it is examined which groups of products have the greatest potential for trade in the coming period. A separate section is dedicated to the analysis of Macedonian and Bulgarian foreign direct investments in both countries and their relative participation in the total direct investments of both countries. Then, the document analyzes the development of tourism between the two countries, that is, the movement of Macedonian and Bulgarian tourists between the countries over the years. This short study concludes with certain general and practical recommendations for the advancement of the economic cooperation of the two countries – as a basis for a prosperous inter-neighborly future.

Is trade between North Macedonia and Bulgaria immune to inter-neighborly relations?

Usually, the deterioration of political and neighborly relations between two countries creates a sense of fear in the business sector for possible disruptions in economic and trade relations, certain administrative restrictions/barriers, termination of certain permits, discrimination against certain investor products, etc. . Hence, our beginning of the analysis refers to determining the trends in trade – did the blockade (veto) by Bulgaria that temporarily hindered the European integration of North Macedonia, a blockade that had the potential to grow into a bigger political conflict – also disrupted the economic and trade cooperation between the two countries. Let’s say in advance that the data cannot confirm a more serious disorder.

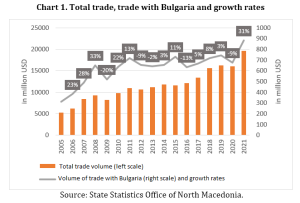

The latest annual statistical data from 2021 show that Bulgaria is the fifth largest trade partner of Macedonia with a trade exchange of 882 million US dollars or a growth of as much as 31% in 2021 compared to 2020. The trade deficit in trade with Bulgaria amounts to 89 million US dollars. Above in graph 1, it can be seen that in the period 2005-2021 trade with Bulgaria follows the trend of the total trade of North Macedonia, i.e. the relative share ranges from at least 4% in 2020 to a maximum of 7% in 2008 and 2011. A negative trade growth rate is found in 2009 as a result of the consequences of the Global Financial Crisis of 2008, in 2012, 2013 and 2016 and in 2020 due to the well-known reasons of reducing economic activities to prevent the spread of the pandemic. caused by the disease Covid-19. Our general conclusion would be that the unfavorable political developments did not directly and seriously affect the trade of the two countries – on the contrary, after the blockade (veto) in 2020, the relative share of trade in 2021 compared to 2020 is increased by one percentage point and is 5% in relation to the total trade of North Macedonia.

In the period 2005-2021, except for 2008, 2013, 2017 and 2018, North Macedonia faces a trade deficit with Bulgaria throughout the period. It had the largest deficit in trade with Bulgaria in 2015 of 186 million US dollars, and the largest surplus in 2008 of 108 million US dollars.

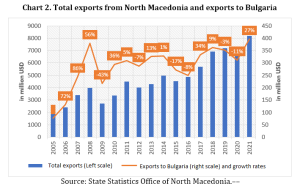

When it comes to exports, in 2021 Bulgaria is the second largest export market for Macedonian companies, in which we had exports worth 396 million US dollars, or a growth of 27% compared to exports in 2020. In 2021, exports to Bulgaria have a 5% share in total exports and this will be maintained for several years. It is clear that the political developments do not have any serious impact on North Macedonia’s exports to Bulgaria. In the analyzed period, the relative share of exports to Bulgaria in relation to the total exports of North Macedonia ranges from a minimum of 4% (76 million US dollars) in 2005 to a maximum of 10% (379 million US dollars) in 2008. The graph shows that exports to Bulgaria followed the trend of total exports.

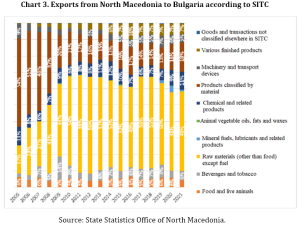

According to the data from the State Statistics Office analyzed by SITC (Standard International Trade Classification) sectors, in 2021, Bulgaria exported mostly raw materials (not food) except fuel (193 million USD). Starting from 2009 until the last year 2021, this item covers almost half of the exports in Bulgaria, and in 2010-2015 and 2017-2019 more than half of the exports. The second largest sector after SITC in exports to Bulgaria is products classified by material ($71 million) with an 18% share in 2021. This item, starting from 2005, when it created more than half of the exports to Bulgaria, follows a decreasing trend and from 2010 onwards every year it has less than 20% relative share in the exports to Bulgaria.

The third sector by volume in North Macedonia’s exports to Bulgaria in 2021 is chemical and related products with a share of 11% (45 million US dollars). Then in the same year in Bulgaria, the export of various finished products amounted to 7% (26 million US dollars), of beverages and tobacco 6% (23 million US dollars), of machinery and transport devices 5% (20 million US dollars), of food and live animals 4% (16 million US dollars), on mineral fuels, lubricants and related products 1% (3 million US dollars).

Analyzed in the time period 2005-2021, it can be concluded that in exports to Bulgaria according to SITC, raw materials (not food) except fuel increased their relative share from 17% in 2005 to 49% in 2021. While, there is an opposite trend in the products classified according to the material. This item reduced the relative share in exports to Bulgaria from 54% in 2005 to 18% in 2021. In the same period, other sectors according to SITC have similar relative shares in exports to Bulgaria.

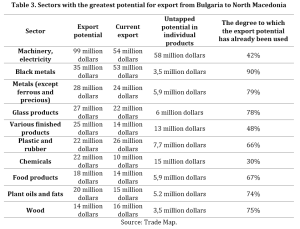

A particularly important question – WHERE, in which sectors can the export from North Macedonia be increased and improved in Bulgaria?

The products with the greatest export potential from North Macedonia to Bulgaria are mineral raw materials, machines, electricity and ferrous metals. Machinery and electricity show the largest absolute difference between potential and actual exports in terms of value units, leaving room for the realization of additional exports worth $27 million. From a relative point of view, motor vehicles and parts have the greatest potential for realizing exports until 2027, because currently only 1% of the export potential is used.

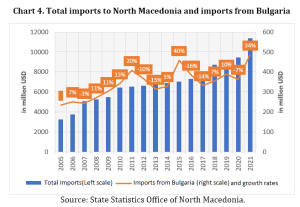

On the import side, Bulgaria in 2021 is the eighth largest partner for the Macedonian economy, from which we had imports worth 485 million US dollars, or a growth of 34% compared to imports in 2020. In 2021, the relative share of imports from Bulgaria remains at 4% in relation to total imports in North Macedonia. In the analyzed period 2005-2021, the relative share of imports from Bulgaria ranged from a minimum of 4% (in 2017-2021) to a maximum of 7% (in 2005-2006 and 2015). From the graph below, it is clearly seen that, as was the case with exports, imports from Bulgaria follow the trend of the total imports of North Macedonia, that is, the trade exchange remains immune to political upheavals.

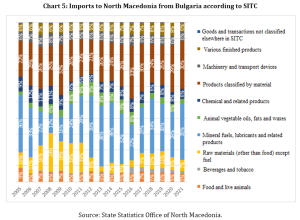

From the point of view of the structure of imports according to the classification of SITC, in 2021, the most mineral manes, lubricants and related products are imported from Bulgaria (171 million USD) with a relative share in the total import of 35%. The graph below shows that the relative share of this item ranges from a minimum of 12% in imports from Bulgaria in 2008 to a maximum of 39% in 2012. The second largest sector after SITC in imports from Bulgaria is products classified by material with imports worth 15 million USD and a 30% share of total imports in 2021. The relative share of this item in the total import from Bulgaria in the period 2005-2021 ranges from 22% in 2005 to 33% in 2016.

In 2021, other sectors according to SITC have single-digit relative participations and are relatively insignificant compared to the first two sectors. Raw materials (non-food) other than fuel account for 7% ($34 million USD), chemical and related products 6% ($31 million USD), machinery and transport equipment 6% ($28 million USD) in Bulgaria’s imports ), various finished products at 6% ($28 million), food and live animals at 5% ($25 million), animal and vegetable oils, fats and waxes at 3% ($15 million), and beverages and tobacco at 2% ($8 million).

Analyzed in the time period 2005-2021, it can be concluded that in the imports from Bulgaria according to SITC, except for mineral fuels, lubricants and related products, products classified according to material and raw materials, there are no major changes in their relative participation in other items in relation to the import from Bulgaria.

The products with the greatest export potential from Bulgaria to North Macedonia are machinery, electricity, ferrous metals and metals (except ferrous and precious). Machinery and electricity show the largest absolute difference between potential and actual exports in value units, leaving room for the realization of additional exports worth $58 million. From a relative point of view, chemicals have the greatest export potential, as 30% of the export potential of this sector is currently used..

What is the situation with foreign direct investments?

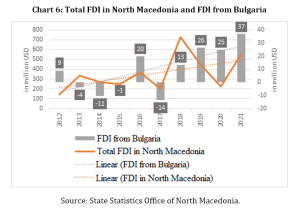

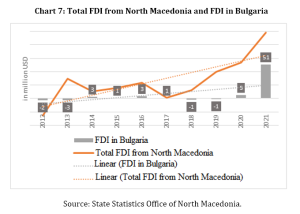

Apart from trade in goods and services, Bulgaria is present in the economy of North Macedonia and through business-investors who had a significant role in certain economic sectors. The graph below shows the role of direct investments from Bulgaria in North Macedonia. The political environment and the creation of a predictable business climate in a country are very important determinants for attracting FDI. As a result, it was expected that the political tensions between Macedonia and Bulgaria from 2020 will reduce joint direct investments. It did not happen, but this situation does not mean that joint investments are at a sufficient level. Of course, there is potential from both sides for more joint investments in more sectors of mutual interest.

In 2021, FDI from Bulgaria amounted to 37 million US dollars out of the total FDI in North Macedonia in the amount of 552 million US dollars and increased compared to 2020 by 49%. However, there is a decline in the relative participation of FDI from Bulgaria from 11% in 2020 to 7% in 2021, but this is due to the 1.5 times increased total FDI in N. Macedonia in 2021 compared to 2020. The largest relative share of Bulgarian FDI in the Macedonian economy was in 2010 with 19%, 11% in 2020 and 10% in 2008. Meanwhile, in 2013, 2014 and 2017, there was a net outflow of Bulgarian capital from North Macedonia.

Regarding Macedonian FDI in the world, the graph shows that after 2017 there is a big jump in direct investments outside the country. But that is not reflected when it comes to Bulgaria. The relative share of Macedonian direct investments is higher compared to Bulgarian direct investments in North Macedonia. Macedonian direct investments in Bulgaria had the highest relative share in 2017 with as much as 86% of the country’s direct investments, 52% in 2021, 23% in 2014 and 12% in 2016. There was a net outflow of Macedonian capital in the years 2012, 2013, 2018 and 2019. In 2021, Macedonian direct investments in Bulgaria amount to 51 million US dollars, which relatively means 10 times greater FDI in Bulgaria compared to 2020.

What is the role of Bulgaria in the development of Macedonian tourism?

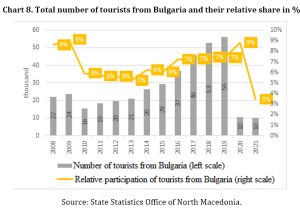

In this section, we analyze the movement of Macedonian and Bulgarian tourists in both countries. From the following chart we can see that the participation of Bulgarian tourists in the total number of tourists visiting the country in the period 2008-2019 ranged from a minimum of 5% (in 2014) to 9% (2008 and 2009). In 2020, due to the Covid-19 pandemic, we see a drastic drop in the absolute number of tourists from Bulgaria, but this coincides with the trend of the total number of tourists and the relative share of Bulgarian tourists remains at the highest level of 9%. But a drastic drop in the relative participation of Bulgarian tourists in North Macedonia occurs in 2021 (3%), one year after the Bulgarian veto on the European route to North Macedonia.

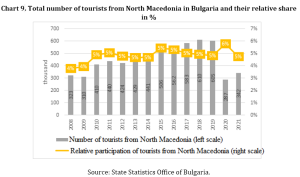

Macedonian tourists, on the other hand, in Bulgaria in the period 2008-2021 have a stable relative participation in relation to the total number of tourists visiting Bulgaria. They always range from 4% (2008 and 2009) to a maximum of 6% (in 2020). There is no drastic drop in the relative participation of Macedonian tourists after the political events, although a slight decrease (in absolute terms) has been observed in the last two years – which are values comparable to the time of the Great Financial Crisis of 2008..

FUTURE DIRECTIONS – HOW TO A PROSPEROUS ECONOMIC FUTURE

Analysis of the data and trends showed that the economic cooperation between North Macedonia and Bulgaria in the past long period of time has a trend of increase and improvement. Even in the moments of the fiercest political turmoil and temporary disruption of good neighborly relations – economic cooperation remained immune and perhaps even remained the last bridge that keeps both sides on the same “wavelength”. Due to the specificity of mutual misunderstandings of North Macedonia and Bulgaria, a certain vulnerability is partially observed in the part of tourism, which is indirectly related to one of the key (sensitive) economic factors – the movement of people. What is particularly important is that in all segments and the exchange of goods/services, the movement of capital and people there are huge potentials for mutual economic synergy and future development. We hope that in the coming period we will witness the realization of this positive/optimistic scenario.

The dynamics of the development of economic relations between North Macedonia and Bulgaria brings numerous potential opportunities and specific initiatives that can be the bearers of the overall development of both countries and the region. Regional and global free trade initiatives turn the two countries into strategic partners in establishing priorities for regional economic cooperation in Southeast Europe. Future joint initiatives in economic cooperation may be aimed at:

- Reduction of differences in legislation and economic regulation in both countries and creation of operational institutions (mechanisms) on both sides to encourage cooperation.

- Overcoming administrative and bureaucratic obstacles in the traffic of passengers and reduction of administrative formalities – Easy flow of passengers/people across the border, by harmonizing customs regulations.

- Facilitation and increase of import/export (reduction of tariffs, harmonization of licenses and permits, elimination of administrative restrictions).

- Stimulation of joint projects and cooperation in the field of tourism.

- Attracting potential investors, protection of joint investments and promotion of joint economic (primarily infrastructure) projects.

- Customs administrations to cooperate and exchange information for more effective cooperation.

- FDI attraction policies and ensuring fair, impartial treatment and protection of foreign investors from the other country;

- Promotion of cooperation between North Macedonia and Bulgaria in the field of infrastructure development (example – the construction of new international road border checkpoints and appropriate road connections) – construction of a railway line and reconstruction of the existing railway sections (construction of a railway line with a track in direction of Kyustendil with a common border station Gjushevo-Beljakovci-Kumanovo; Better connection through road links of the international road border checkpoints: the town of Sandanski and the village of Struma on the territory of Bulgaria with the town of Berovo on the territory of North Macedonia; the town of Simitli on the territory of Bulgaria with the city of Pehcevo on the territory of North Macedonia, etc.)

Thanks for the contribution from colleagues – M.Sc. Günter Mercan M.Sc. Kristijan Kozheski from the Faculty of Economics – Skopje.

This analysis is part of the project: „Demystifying the (un) neighborly relations on the path to the EU: The case of North Macedonia and Bulgaria“, through the Canadian Fund for Local Initiatives (CFLI).The content of the publication is the sole responsibility of EUROTINK-Centre for European Strategies and can in no way be considered to reflect the views of the Canadian Embassy in Belgrade and the Canadian Fund for Local Initiatives.